I have previously discussed my use of options in my personal account, whether to capitalize on specific opportunities or to hedge positions in my long portfolio. Many of you have expressed interest in understanding my approach to options trading.

Now, I aim to provide you with the tools I utilize for more advanced trading strategies, helping you reach a level of comfort to engage in such trades yourself.

The following series is tailored to offer foundational knowledge for those interested in incorporating options into their overall investment approach. However, it's crucial to recognize that options trading is not suitable for everyone.

It's essential to emphasize from the outset that options entail inherent risks, with the potential for a complete loss of your investment or more.

For instance, consider this scenario: Suppose you purchase 100 shares of XYZ at $10 per share, anticipating a rise to $12 within the next month, aiming for a $200 profit. If XYZ instead falls to $9.50, you can sell the stock and limit your loss to 50 cents per share (or $50 total). Even if XYZ reaches only $11 by the end of the month, you still earn a $1 per share profit ($100 total, or 10% gain).

Unlike stocks, options trading requires accuracy in predicting not just the direction and price of the asset but also factors like timing and volatility to profit from the trade. The option price is influenced by these variables, making it a multidimensional challenge compared to stock trading.

For instance, if you purchase an XYZ $12 call option (more on "call options" soon) expiring in 30 days while the stock is trading at $12, different outcomes are possible. If XYZ drops to $9.50, your $12 call option could significantly depreciate in value. If XYZ fails to exceed $12 upon expiration, you risk losing the entire amount paid for the option, given that options are time-sensitive assets.

In essence, buying options involves a race against time, where you predict the stock price by a specific date.

Options trading may appear complex and risky, particularly for inexperienced individuals. However, like a chef's knife, which can be perilous in untrained hands but indispensable for a skilled cook, options can serve as a valuable tool in the investment arsenal of knowledgeable traders.

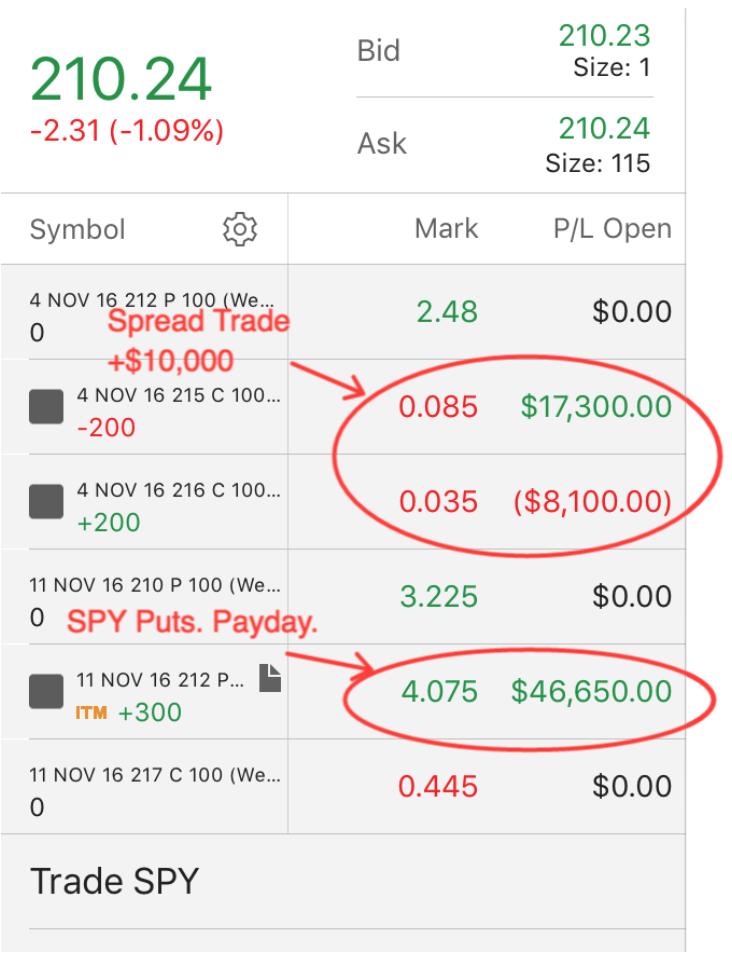

Feel free to refer to the actual trade screenshot I've shared below as an example.

Trading options can be highly profitable. Therefore, before delving further into these lessons, I highly recommend downloading the booklet "Characteristics and Risks of Standardized Options" published by the CBOE. Reading this booklet will greatly enhance your understanding of the lessons I will impart and solidify the concepts I'll be teaching.

Now, before you rush into opening an options trading account, let's discuss the concept of suitability. Brokerage firms typically impose four levels of Option Approval on investors, which dictate the type of account you can establish.

In essence, it is advisable to allocate only risk capital—funds you can afford to lose—towards options trading. While nobody trades with the intention of losing money, it's crucial to understand that options trading is speculative, not investing.

Here's an overview of the four levels of Option Approval your broker may assign to your account:

Approval Level One: Allows you to purchase cash-secured puts (not on margin) and write covered calls. To attain this level, you must already hold common stocks in your account. Moreover, you can only trade options of the stocks you currently own, with the number of contracts limited to your stock's long position (e.g., owning 100 shares of XYZ allows you to buy or sell only 1 XYZ put or call at a time).

Approval Level Two: Provides Level One privileges and permits you to buy any number of puts or calls based on your available cash or margin buying power, including options on stocks, ETFs, or indexes.

Approval Level Three: In addition to Level Two capabilities, Level Three enables you to trade spreads. You can engage in short spreads if you possess adequate liquidity but are restricted from uncovered shorting.

Approval Level Four: This represents the highest Option Approval tier. It encompasses all Level Three functionalities and grants you the authority to write naked calls and puts.

In the upcoming lesson, I will introduce you to the fundamental uses of Puts & Calls—explaining what they are and how they can be utilized to achieve diverse investment objectives.