Having established a solid foundation in options trading, it is now essential to explore the correlation between an option's premium (or price) and the market value of the underlying asset. An option's premium is comprised of intrinsic value and extrinsic value, also referred to as time value.

Intrinsic Value:

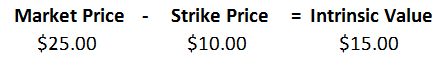

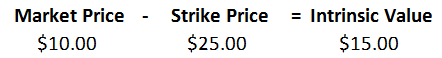

The intrinsic value of an option is the variance between the option's strike price and the present market price of the underlying stock. For a call option, the formula for calculating intrinsic value would be as follows:

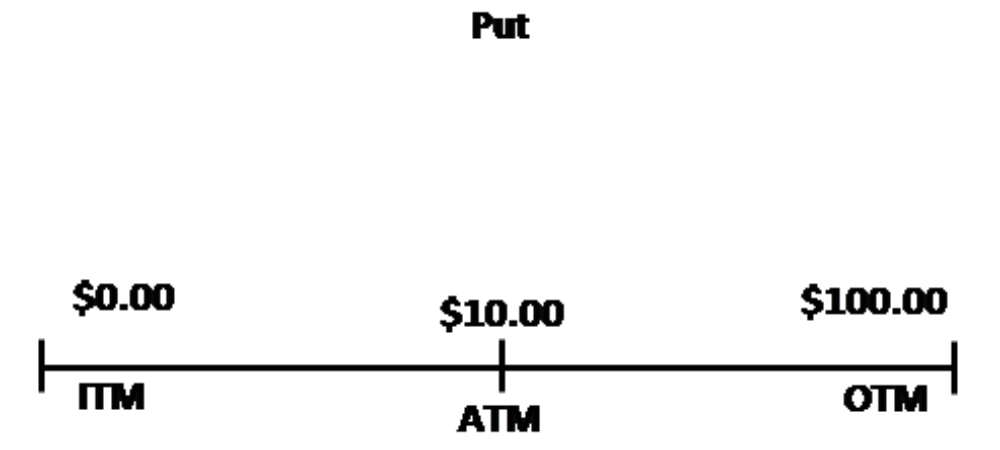

For a put option the math is backwards. That’s because the put gives you the right to sell, whereas the call gives you the right to buy.

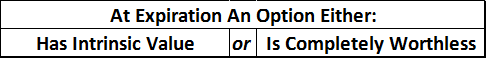

At expiration, an option holds value only based on its intrinsic worth.

Extrinsic Value:

Options are characterized as deteriorating assets, containing a time value and a probability factor within them. For instance, suppose a stock is priced at $100, and you purchase call options with a $105 strike price. If these options expire within an hour, their value will be minimal. However, if the expiration is set for 100 days, there exists a possibility that the stock might appreciate to that level, resulting in the options retaining some value.

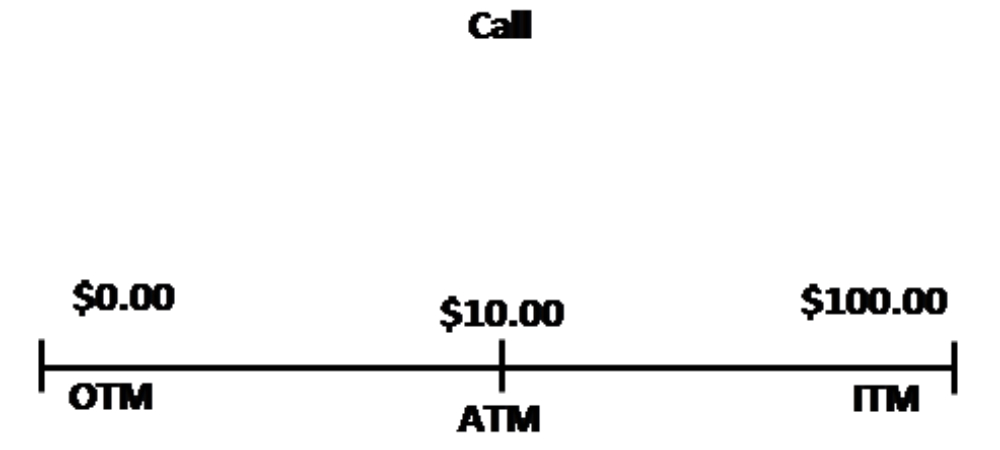

When an option possesses intrinsic value, it is categorized as being "in-the-money."

Conversely, options in the "out-of-the-money" and "at-the-money" categories solely involve extrinsic value.

Example:

The option exhibits no intrinsic value when its price ranges from $0.00 to $10.00. However, once the price exceeds $10.00, the option starts to hold intrinsic value.

Here is an example illustrating a put option scenario when the stock price is trading at $10.00 per share.

Options are categorized as in-the-money, at-the-money, or out-of-the-money based on their relationship to the underlying asset's price.

The premium of an option comprises Intrinsic Value and Extrinsic Value, also known as Time Value.

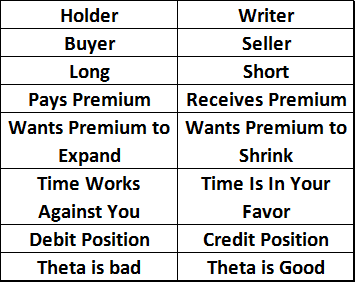

The buyer (or holder) of an option pays the premium, while the seller (or writer) receives it. I have also noted that an option's premium consists of intrinsic value and time (extrinsic) value.

Intrinsic value represents the disparity between the current market price of the underlying stock and the option's strike price. Extrinsic value, on the other hand, is the time value encompassing the probability and time aspects related to options.

Upon expiration, the option premium will either equal the intrinsic value or be reduced to zero.

Any option that holds even a minimal intrinsic value will be automatically exercised upon expiration.

Certain index options are settled in cash, eliminating the need to be concerned about assignment.

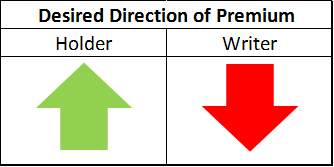

Buyers of options want their premium to increase while sellers of options want the premium to decrease.

Selling Option Premium:

When you engage in selling an option, your aim is for the extrinsic value to diminish to nothing by the time of expiration. In scenario, time is on your side. Moreover, a decline in volatility will also reduce the option's worth, which is favorable for the premium seller.

Buying Option Premium:

By an option, you stand to gain when the stock moves in alignment with your chosen option. For instance, if you buy a call option, you profit from an increase in the stock price. Furthermore, an uptick in implied volatility enhances the value of an option.

Conversely, time acts as a drawback if the option still holds extrinsic value.

Time Value:

Options are characterized as depleting assets, as they carry a distinctive expiration date, marking the point at which they expire.

The following table consolidates key concepts for better clarity.

Don't fret if you're not familiar with the concept of theta at this point - we'll delve into that topic in a future lesson. Theta essentially represents one of the options Greeks and indicates the option's responsiveness to the passage of time until expiration.

Next, let's shift our focus to one of the crucial elements of options trading, which is volatility.