In the preceding lessons, we went over the fundamental aspects of options, equipping you with a solid grasp of how calls and puts function.

Now, you might be pondering, "How can I profit from options?"—and that's precisely what we're here to explore, right?

A key advantage of options is their provision of leverage. With just one option contract, you gain the ability to command 100 shares of a stock.

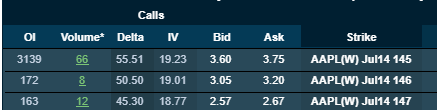

Consider this scenario: Apple's current price stands at $145.80 per share. To own 100 shares, you would need $14,580. On the contrary, by purchasing a near-the-money call option—such as the $146 strike set to expire in 30 days—for around $3.20 ($320), you obtain control over the same 100 shares.

Clearly, options offer a substantial amplification of your investment potential.

Utilizing Strategic Approaches to Enhance or Safeguard Your Portfolio

Long Put Strategy

Suppose you currently hold 100 shares of XYZ and have seen gains on this position. If you're concerned about market conditions and wish to safeguard your profits without selling the stock, one option is to purchase a put for protection. In the event of a decline in XYZ's share price, the put option's value will increase, effectively hedging your long stock position.

For instance, if XYZ is priced at $15.00 and you acquire a 15 put option for $3.00 just before XYZ drops to $10.00, your put's value could rise to approximately $5.00. This strategy limits your potential loss to -16.67% instead of the full -33.33% if you had not secured the put. This combined long stock and long put approach is commonly known as a married put and mirrors the risk/reward characteristics of a long call option.

Short Call Strategy

Another method to hedge a long stock position is by writing a call against it—a strategy termed a covered call, as ownership of the stock acts as coverage for the short call should it be exercised.

Consider an example where you possess 100 shares of XYZ but anticipate limited upward movement in its price. With XYZ trading at $15.00, you decide to sell an XYZ 15 call option fetching a $3.00 premium.

As the call writer, you face the obligation to sell your stock if the share price surpasses $15.00 before expiration. If XYZ indeed rises to $17 at expiration, you profit $200 from the long stock position and an additional $100 from selling the call option. However, your long stock is likely to be called away as the short call expires in the money. Conversely, if XYZ drops to $13 by expiration, you lose $200 from the long stock but gain $300 from the call option sale.

Generally, traders favor selling out-of-the-money options when employing this strategy. It's crucial to recognize that this approach offers only partial hedging compared to purchasing a put. The covered write aligns with the risk/reward profile of being short a naked put.

Synthetic Strategies

By structuring positions to mimic stock profiles, one can employ synthetic strategies.

A synthetic long position involves buying an at-the-money call while simultaneously selling an at-the-money put. This strategy closely resembles owning the stock directly, with the put premium offsetting the call premium.

On the other hand, a synthetic short position is constructed by purchasing an at-the-money put and selling an at-the-money call. Here, the risk/reward profile mirrors that of being short the stock.